Your location:Home >Automotive News >

Time:2022-06-15 12:26:10Source:

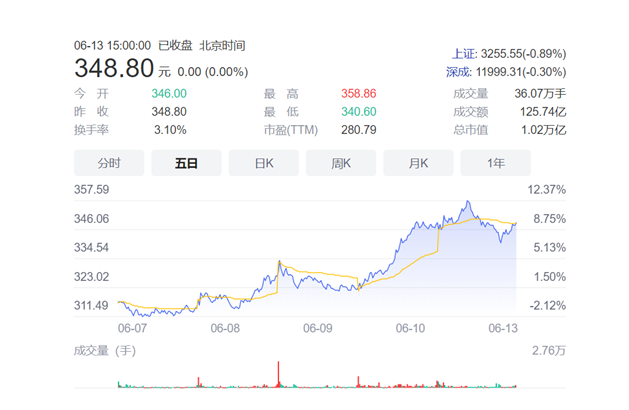

In the past week, themost memorable moment in China'snew energy vehiclesector, most people must vote for Beijing time on June 10, BYD's A shares rose nearly 7% intraday, and the market value exceeded one trillion for the first time. It reached a new record high and became the first independent brand to enter the "Trillion Market Value Club".

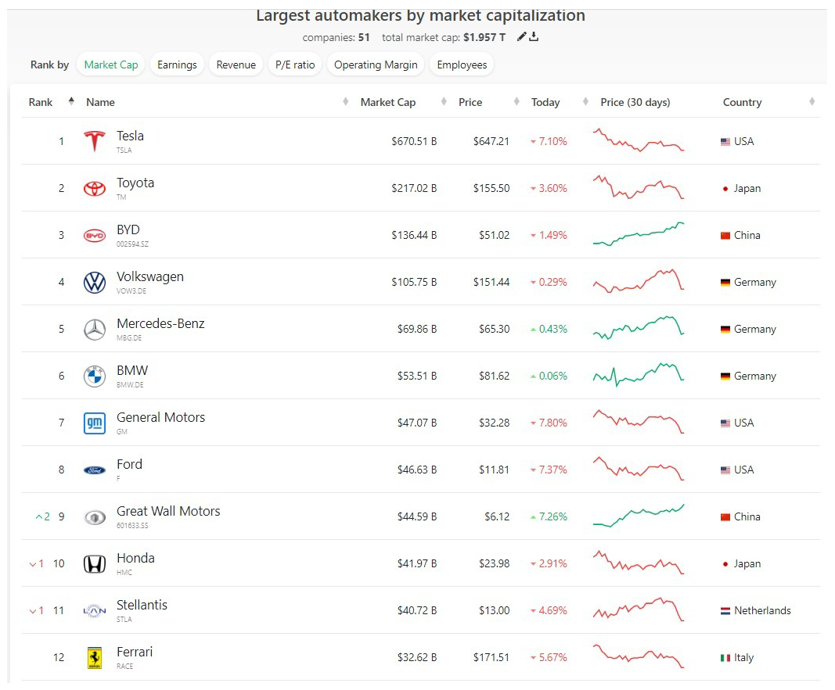

Even though as of the close on June 13, Beijing time, the above two data have fallen, but it still maintains its capital highlight moment.In terms of market value alone, it surpasses Volkswagen and ranks third in the overall ranking of global car companies. The overall situation is very good.

It is very interesting that, also recently, Tesla, which currently ranks first in the global car company by market value, officially submitted a document to the US Securities and Exchange Commission (SEC), announcing that the 2022 shareholders meeting will be held on August 4th, local time in the United States. , at the Texas Gigafactory.

At that time, 13 proposals will be voted on.Among them, Tesla said in the four th proposal that the company will split its shares in a "3:1" ratio.

After learning about it, I learned that this is also its second stock split in the past two years.The node for the first "5:1" stock split will be August 2020.After the official implementation, it immediately triggered a crazy surge in stock prices.As of June 2022, the cumulative increase has exceeded 40%.

In its latest filing with the SEC, Tesla said: "The second stock split is to provide employees with greater flexibility in managing their equity, while also making it easier for ordinary people to buy Tesla stock."

However, as an onlooker clearly knows that since entering 2022, it is limited by many force majeures, and the performance of this Americannew energyvehicle company in the capital market is really not dazzling.Especially in terms of market value, it has quickly dropped from the trillion-dollar in the most glorious time to about 720 billion US dollars.

Therefore, the fundamental purpose of the stock split is to inject a "cardiac" and absorb more fresh blood to sweep away the decline.

Seeing this, I can't help but lead to the final theme that I want to discuss in today's article: If you have 1 million, is it BYD or Tesla?

In other words, one side is the hottest "star brand" among Chinese new energy vehicle companies, and the other side is the well-deserved "absolute wind vane" of the global new energy market at the moment. Who has more investment potential?

And this is precisely what has been mentioned many times when talking with many friends around me recently.However, I still want to explain in advance that for such a very open question, from different perspectives, everyone will inevitably have their own answers.

Open the webpage to search at will, and articles similar to the mutual comparison between "BYD and Tesla" are also not uncommon.Therefore, personally, I would like to talk about my views from three aspects.

First of all, based on the first-quarter sales results that have been announced so far, BYD's new energy vehicles sold a total of 284,500 units, and Tesla has delivered more than 310,000 new vehicles globally.

But it must be known that in the second quarter, with the raging epidemic in Shanghai, China, Tesla was forced to suspend production at its only factory in China for 19 days, which has already caused a largeloss ofproduction capacity. less than expected.According to Musk's expectations, Tesla's delivery target in 2022 will reach 1.5 million vehicles if the production capacity is sufficient.

In contrast, BYD, although in the same predicament, has achieved monthly sales of 100,000+ for three consecutive months thanks to its supply chain with strong resistance to risks and self-control capabilities.

At the 2021 shareholder meeting held recently, its official conservative estimate that the total sales in 2022 will reach 1.5 million vehicles, and if the supply chain is better, it is expected to hit 2 million vehicles.

Obviously, if the timeline is extended to the whole year, BYD is very likely to overtake Tesla.

The second is the earning power of both.Taking the first quarter financial report as an example, Tesla’s total revenue reached US$18.756 billion, or about 126.342 billion yuan; its net profit reached US$3.736 billion, or about 25.166 billion yuan; the gross profit margin was 32.9%.

In contrast, BYD's total revenue in the first quarter was 66.825 billion yuan, with a net profit of 808 million yuan and a gross profit margin of 15.6%.

There is no doubt that in this one, Tesla has achieved a huge victory.

Furthermore, it is the characteristics of the roles played by both parties.Focusing on Tesla, the first thing to focus on is its absolute leading edge in the pure electric sector in terms of products, especially after the launch of Model 3 and Model Y.

The two models have many points of praise in terms of forward-looking interior and exterior design, integration of electronic and electrical architecture, advanced assisted driving, comprehensive energy consumption performance, driving texture, energy supplementation system, and sales model.

The more important and easily overlooked point is that after surviving that period of production hell, Tesla has grown into one of the most powerful car companies in the world, and it has become more and more comfortable to build more super cars through iterative production processes. Factory, erecting new longboards.

Coupled with the ultimate cost control ability, the above two models have the confidence to adjust prices at any time on the premise of maintaining crazy money.Also, don't forget, who actually stands for the brand?

Even though Musk's arrogant personality and controversial operations on many things will always be ridiculed and watched indifferently by the outside world, he still cannot stop him from continuing to exude a very unique personality charm, which in turn empowers Tesla.

As for BYD, it must be admitted that if the time goes back a few years, its volume is far less high-pitched than it is now.

The real turning point must be that after the successful launch of the DM-i hybrid technology, it gave up the ultimate pursuit of power and acceleration, and instead focused on the lowest possible energy consumption performance and economy in the process of car use.The choice after thinking and choosing in this way has already spawned a group of "star models" that are good enough.

And when self-owned brands realized that the "hybrid technology route" could be the best entry point for the new energy track, BYD has become difficult to catch up with its overall cost control advantages, and it has gradually grasped the plug-in. The "pricing power" of the mixed market.

In addition, the safety and cost advantages of blade batteries are becoming more and more prominent. On the pure electric track, BYD has also gained recognition from end users.

After gradually transforming into a good enough new energy car company, after years of foreshadowing and accumulation, BYD's active "exporting to the outside world" is another route it has chosen.In other words, strive to play the role of a leading supplier of new energy.

As for the phased results, getting the full power battery orders from Tesla can already explain many things.The corresponding Fudi battery has also won more than 30 external OEM customers in the past year.The outstanding performance of the DM-i hybrid system has also aroused the attention and eagerness of other car companies.

To sum up, the roles played by the two car companies can be said to be different.

Located in the global new energy market, Tesla must occupy an absolute dominant position, and Musk can also be called an "opinion leader".In China's new energy market, even if the former is still strong, please do not underestimate the speed of BYD's rise.

At the end of the article, I went back to the question that was raised. After a series of analysis, the answer can be said to become clearer and clearer: in terms of sustainable growth and future prospects, I would like to use "evenly divided, each wins one" to describe the two companies. car company.

If you have 1 million, and take out 500,000 heavy positions for BYD and Tesla respectively, it may be the way to maximize benefits.

So, if it were you, how would you choose?

Statement: the article only represents the views of the original author and does not represent the position of this website; If there is infringement or violation, you can directly feed back to this website, and we will modify or delete it.

Preferredproduct

Picture and textrecommendation

2022-06-15 12:26:10

2022-06-15 12:24:43

2022-06-15 12:23:59

2022-06-15 12:17:33

Hot spotsranking

Wonderfularticles

2022-06-15 12:11:36

2022-06-14 10:21:19

2022-06-14 10:20:40

2022-06-14 10:19:23

2022-06-14 10:18:36

Popularrecommendations