Your location:Home >Automotive News >

Time:2022-06-29 14:50:36Source:

As the basis for the evolution of autonomous driving, large computing power chips are ushering in a period of rapid development with the continuous advancement of the intelligent driving functions of new cars.

In order to achieve a better intelligent driving experience in new cars, since last year, many mainstream car companies have announced that they will be equipped with large computing power chips on their next-generation products. The supply order has also contributed tothe situation thatNVIDIAis the only one in the field of large computing power chips .

But this year, as local companies represented by Huawei, Horizon, and Black Sesame Intelligence have announced mass production projects for large-scale computing chips and computing platforms, at the same time, new companies represented by Cambrian Xingge, Ambarella, Mobileye, etc. Players have joined the big computing power chip track one after another, which is expected to breakthe market pattern of the original one, and enter a new era of competition in which the masses compete.

Large computing power chips welcome the first year of mass production, "independent core" accelerates breakthrough

For autonomous driving, although a large computing power chip is not omnipotent, it is absolutely impossible without a large computing power chip.

With the rapid evolution of autonomous driving from ADAS to high-level autonomous driving, in order to support the system to cope with various complex conditions, a large number of cameras, millimeter-wave radars, and lidars and other sensors must be loaded on the vehicle for comprehensive environmental data collection.According to relevant analysis data, in order to meet the perception needs of intelligent driving, L2-level cars are expected to carry 6 sensors, and at L5-level, it is expected that a single vehicle will carry 32 sensors.

How big is the amount of data generated from this?According to estimates by industry experts, a self-driving car can generate between 5 TB and 20 TB of data per day, and the higher the level of autonomous driving, the more data is generated.To process this information quickly and make driving decisions, large computing power chips are indispensable.

Seeing this demand, in the past few years, companies represented by NVIDIA, Qualcomm, Horizon, and Black Sesame Intelligence have successively started to deploy large-scale computing power chips.Among them, NVIDIA released Orin, a large computing power autonomous driving chip as early as 2019. With a single-chip computing power of up to 254 TOPS, as well as NVIDIA's long-term accumulation in the AI field, and giving partners an open and efficient R&D ecosystem, it quickly gained a Favored by car companies and autonomous driving technology companies.

Image credit: Gasgoo

On this basis, NVIDIA released a new generation of self-driving car SoC DRIVE Atlan in April last year. According to official information, the computing power of a single Atlan chip can reach 1000TOPS, and samples will be provided to developers in 2023. loading.DRIVE Hyperion 9, an autonomous driving platform based on Atlan, is reported to support up to 50 sensing hardware.

Another veteran chip manufacturer, Qualcomm, is also actively promoting the mass production of large-scale computing power chips for autonomous driving, and has launched the Snapdragon Ride SoC based on the 5nm process technology.This SoC can support the development of autonomous driving systems from L1 to L4, and can provide different levels of computing power according to different autonomous driving scenarios, covering a computing power range of 10-700 TOPS.

The Snapdragon Ride SoC was initially expected to enter production in 2023.However, according to the latest news, the Little Magic Box 3.0 autonomous driving computing platform based on the Snapdragon Ride SoC built by Great Wall's Momo Zhixing will be officially mass-produced this year with the launch of related models.This means that Qualcomm is advancing Snapdragon Ride mass production faster than originally planned.

In China, local chip companies represented by Huawei, Horizon and Black Sesame Intelligence have also ushered in important breakthroughs in the mass production of large computing power chips this year.

Image credit: Gasgoo

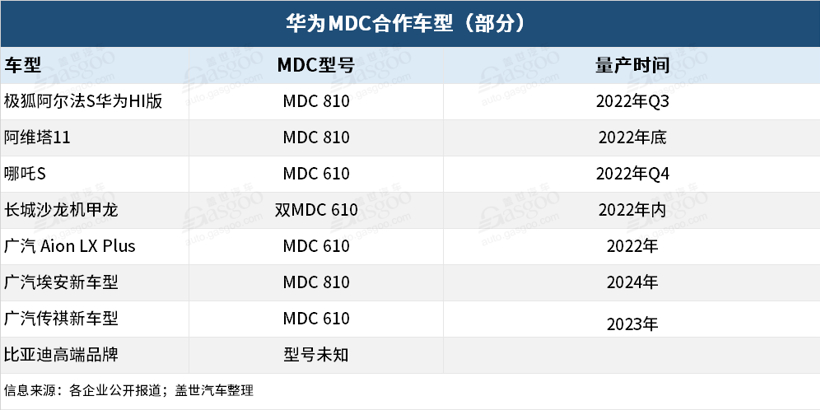

Among them, Huawei's self-developed self-driving AI chip, which has been installed on the vehicle-level intelligent driving computing platform MDC, has successively obtained the Extreme Fox Alpha S Huawei HI Edition, Great Wall Salon Mecha Dragon, Avita 11, GAC Aion LX Plus, Nezha S, as well as BYD and Chery high-end brand models, will be officially mass-produced this year with the delivery of related models.

Gasgoo 2022

Recently, the platform has officially applied forIt is understood that the computing power of Huawei's MDC platform covers 48~400 TOPS, and includes 4 different versions, namely the MDC 300F for commercial vehicle scenarios, as well as the MDC 210, MDC 610 and MDC 810, which can support from L2+ to L4 and even L5 autonomous driving research and development at different levels.

For example, the new HI version of Alpha S and the MDC810 intelligent driving computing platform equipped with Avita 11 can achieve super computing power of 400TOPS.The MDC 610 on the Great Wall Salon Mechadragon, GAC Aion LX Plus, Nezha S, etc., has a computing power of 200+ TOPS. Among them, the Mechadragon is equipped with dual MDC intelligent driving computing platforms, and the comprehensive computing power reaches 400 TOPS.At present, Huawei MDC is planning a medium computing power platform of 128TOPS, which is expected to be available by the end of this year.

Journey 5 chip, image source: Horizon

Following the official release of the 128TOPS large computing power chip Journey 5 at the end of July last year, Horizon has obtained the appointment of BYD, Zijia Automobile, FAW Hongqi and other car companies on Journey 5 in the past few months, and has cooperated with Hongjing Zhijia and Juefei Technology. , Qingzhou Zhihang and other autonomous driving technology companies have reached cooperation, and it is expected that the mass production of the large computing power chip Journey 5 will be officially realized next year.

In particular, it is worth mentioning the cooperation with BYD, because shortly before the official announcement, BYD has actually reached a cooperation with NVIDIA on Orin getting on the car, saying that starting from the first half of 2023, somenew energymodels of BYD will also be equipped with An autonomous driving system built with Orin chips.The achievement of this new fixed-point project undoubtedly highlights BYD's recognition of Horizon's strength.

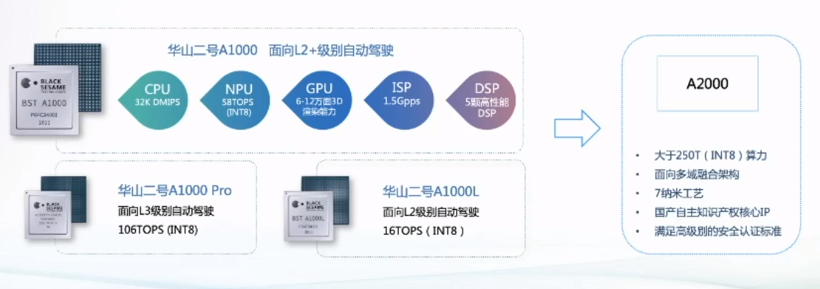

Image source: Black Sesame Smart

Black Sesame Intelligence announced last month that it has reached a platform-level strategic cooperation with Jiangqi Group. The two parties will integrate their respective advantages, based on Huashan No. 2 A1000 series chips, as well as supporting upper-level software algorithms, Shanhai tool chain, Hanhai autonomous driving middleware, etc. platform, and jointly create an integrated intelligent driving platform for parking and parking, which is the first to be applied to the mass-produced models of Jiangqi Group's Sihao series.

According to previous news, the Huashan No. 2 A1000 series is scheduled to be delivered from June this year, and will officially usher in large-scale mass production in the second half of the year with the launch of related models.At the same time, Black Sesame Intelligence is also carrying out the research and development of the next-generation product A2000 series chips, and plans to target the functional requirements of "central computing".It is understood that the A2000 is based on an advanced 7-nanometer process design, and the single-chip computing power can reach more than 256TOPS. It is planned to be released within this year, and samples will be provided to OEMs from next year.

However, on the whole, the large computing power chip market for autonomous driving is still dominated by NVIDIA.According to NVIDIA's previous release of the financial report for the first quarter of fiscal year 2023, more than 35 automakers around the world have confirmed that they will use NVIDIA's Orin system-on-chip, including Weilai, Xiaopeng, Ideal, Weimar, SAIC Zhiji, BYD, Volvo, Lotus, etc.

Among them, NIO became the world's first car company equipped with Orin with the ET7 delivered at the end of March, thus officially opening the door to mass production of large computing power chips.On June 21, the Ideal L9 was officially launched. The car also uses two NVIDIA Orin-X processors in the design of the intelligent driving computing platform to achieve a computing power of 508 TOPS.Next, NIO ET5 and ES7, Xiaopeng G9, Weimar M7, Feifan R7 and other new cars equipped with Orin will also be mass-produced and delivered, which is expected to usher in a wave of high computing power chips.

New players poured in one after another to face the second half of the big computing chip

Judging from the evolution trend of autonomous driving, it is clear that the higher the level of autonomous driving, the greater the demand for computing power.

The industry generally believes that the computing power required for L2 autonomous driving is below 10TOPS, the computing power required for L3 is about 30~60TOPS, the computing power required for L4 exceeds 100TOPS, and the computing power required for L5 exceeds 1000TOPS.

However, at present, the speed of boarding of large computing power chips has exceeded many people's expectations.For example, NIO's ET7, ET5, ES7 and Weimar M7 all use 4 Orin chips to achieve 1016TOPScomputing power.The just-launched Ideal L9 and the upcoming Xiaopeng G9 are planned to be equipped with 2 Orin chips to achieve 508TOPS computing power.FAW Hongqi plans to use multiple Journey 5 chips to build an intelligent driving domain controller, providing a powerful AI computing power of 384~512 TOPS for the new-generation service-oriented FEEA 3.0 electronic and electrical architecture.

Analyzing the reasons, on the one hand, because of the emergence of the trend of software-defined automobiles, "hardware pre-embedded, software upgrade" has become the mainstream strategy of current car companies. To meet the need for continuous iterative optimization of the vehicle's intelligent driving function, OEMs have to pre-embed high-performance sensors and large computing power chips in mass-produced vehicles to support the continuous evolution of the vehicle's automatic driving function in the future.

Image source: Black Sesame Smart

It can be seen from the above table that the number of sensors on the new cars announced to use NVIDIA Orin is basically 30 or more, for example, the number of sensors configured by Weilai ET7, Weimar M7, and Feifan R7 has reached 33. , and these models will use lidar without exception.Among them, the Weimar M7, which will use 4 Orin chips, will even be equipped with 3 lidars, while Lotus Eletre is reported to be equipped with 4 lidars.

On the other hand, as the electronic and electrical architecture of the whole vehicle continues to evolve from distributed to centralized, it also puts forward higher requirements for large computing power chips.In the L2 and L2+ stages, many chips in the car may still be opposites, but when it develops to L3 or even L4 and L5, the electronic and electrical architecture of the whole vehicle continues to move from cross-domain integration to the central computing architecture, and the integration requirements for chips will increase. The higher it is, the higher the corresponding computing power requirements will be.

However, it is not easy to develop such a large computing power chip. First of all, it needs to be very forward-looking in the early stage of design.Earlier, when talking about the large computing power chip, Yang Yuxin, the CMO of Black Sesame Intelligence, pointed out that the functional requirements after 5 to 10 years must be taken into account when defining the chip, because the chip may be launched in 5 years, and the supply cycle may be 5 years. ~10 years.

Secondly, for mass-produced vehicles, when choosing a chip, OEMs not only consider the level of computing power, but also consider multiple factors such as cost, power consumption, chip adaptability, and development convenience.In the process of chip development, if you only focus on computing power and ignore power consumption, there will be greater risks to the temperature control and quality control of the entire vehicle, and it will also cause a greater burden in terms of cost.

Image credit: Horizon

Horizon believes that TOPS alone cannot measure the real performance of the chip. For AI chips, the more worth pursuing value should be the operating efficiency of advanced algorithms on the chip, that is, FPS (accurate frame rate per second), only Higher FPS will bring faster perception and lower latency, which means higher safety and driving efficiency.Because once the AI chip calculates frames, it is likely to have catastrophic consequences for autonomous driving that needs to ensure real-time perception.

Horizon has also been committed to optimizing chip performance from the perspective of improving combined computing efficiency.It is understood that although the computing power of Journey 5 is only half that of Orin, its FPS is as high as 1283 when performing autonomous driving tasks, which may be the reason why more and more car companies choose Horizon.

Based on this, how to realize the efficient operation of algorithm software under the condition of limited computing power at this stage is actually the real focus of OEMs.According to relevant industry sources, even at present, there are still many algorithms that cannot be well reflected on the existing AI computing power platform.Moreover, the autonomous driving large computing power chip itself also faces the complexity of system architecture design, engineering challenges in packaging, cost control, yield and other aspects, as well as challenges in advanced technology.

"In addition, when many car companies choose a large computing power chip platform, they are not only to meet the needs of one car, but will cover multiple different models at the same time, which requires the large computing power platform to have enough power at the same time. Flexibility and scalability, and can provide supporting tool chains, software stacks, etc. at the software level." Recently, Ai Hezhi, senior director of product marketing at Qualcomm, said in a live broadcast event.

#FormatImgID_6#

Image source: Silicon Engine Technology

year

Despite this, this has not affected the determination of chip companies to pursue large-scale computing chips.Cambrian Xingge, an automotive chip subsidiary of Cambrian Holdings, revealed that it will release two autonomous driving chips this. Among them, the SD5226 for the L4 market will use the 7nm process, the AI computing power will exceed 400 TOPS, and the maximum CPU computing power will exceed 300K+DMIPs.

Chipchi said that it will launch an autonomous driving processor with a single-chip computing power of 200TOPS in the second half of the year.In addition, Syntech also stated that it has started the research and development of the AD1000 autonomous driving chip, which also uses a 7-nanometer process and applies a scalable design, making it suitable for L2+ to L5 autonomous driving systems.However, these companies did not give a specific mass production time.

Ambarella and Mobileye will launch their respective high-power chip products at the 2022 CES.Among them, Ambarella’s CV3 uses a 5nm ultra-low-power process, 16 Arm Cortex-A78AE CPU cores, and a single-chip AI computing power of 500 eTOPS.According to Ambarella, the first samples of the CV3 series of chips will be launched in the first half of 2022, and then products with different positioning will be launched according to market demand.

Although Mobiley's EyeQ Ultra chip has a computing power of 176 TOPS, it is expected to be available at the end of 2023 in terms of commercialization time, and will fully achieve vehicle-level mass production in 2025.

You must know that Mobileye was the absolute overlord in the smart driving chip market. However, in the process of developing to high-end autonomous driving, Mobileye seems to be half a beat slower.Moreover, from the perspective of major chip companies such as Horizon and Black Sesame Intelligence, 2025 will be the time when the current round of automotive AI chip market window closes, which means that there is not much time left for Mobileye.

As more and more new players continue to influx, and at the same time, the demand for chips in the autonomous driving market continues to explode, the large computing power chip track is expected to enter a new round of competition.

Statement: the article only represents the views of the original author and does not represent the position of this website; If there is infringement or violation, you can directly feed back to this website, and we will modify or delete it.

Preferredproduct

Picture and textrecommendation

2022-06-29 14:50:36

2022-06-28 17:13:45

2022-06-28 17:13:09

2022-06-28 17:12:27

2022-06-28 17:11:47

2022-06-28 17:10:58

Hot spotsranking

Wonderfularticles

2022-06-28 17:09:59

2022-06-28 17:00:42

2022-06-28 17:00:01

Popularrecommendations