Your location:Home >Automotive News >

Time:2022-07-01 15:33:20Source:

In 1880, the French Gustav Truff invented the world's first electric car, but in the following century, it was the internal combustion engine car invented by Benz, which was born four years later.

In the past 100 years, the car has gradually developed from a simple means of transportation to the second mobile space for human beings besides the house. People's understanding of travel has gradually upgraded from a simple displacement to a more comfortable, rich and changeable one.

It was not until the 21st century that electric vehicles returned to the mainstream vision.

Although it was a late episode, when it came back again, its fuel car brother not only did an early "user education" for it, but also left excess emission pollution, which contributed to a clean and intelligent "savior". Appear.

Electric cars have finally ushered in their home.However, the replacement of old things by new things is often accompanied by the breaking and reconstruction of existing interest circles, especially the electric vehicle supply chain with many interests and intricate relationships.

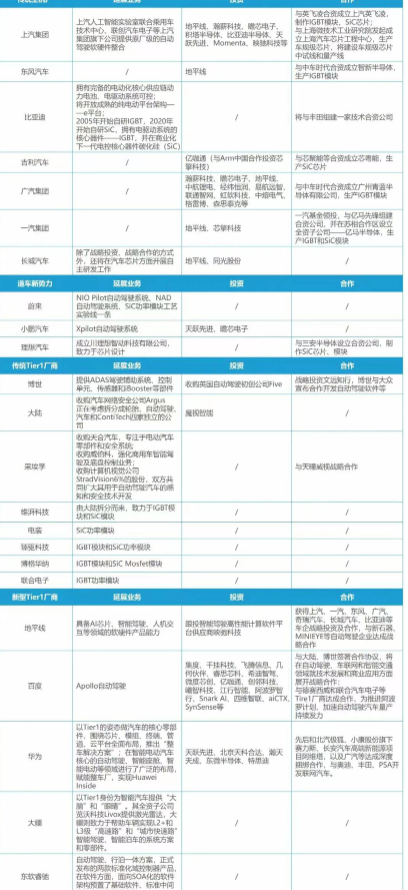

Among them, Tier 1 (a first-tier supplier of car companies) was the right-hand man of the OEM in the past. With the intelligent evolution under the wave of electrification, the concept of Tier 1 has also been updated, and more intelligent incremental components have been integrated. , new car-making forces, traditional Tier 1 and emerging hard technology manufacturers end up one after another, and fights between gods and gods are inevitable.

Traditional Tier 1 manufacturers, the strongest deputy of OEMs

Tier 1 is a product of the era of fuel vehicles, and it has a tacit understanding of the role division of OEMs.

As a first-tier supplier, Tier1 is directly related to the OEM, not only directly providing assemblies and modules for the OEM, but also participating in each other's R&D and design with the OEM, and is the supplier with the strongest participation in the vehicle manufacturing process .

Throughout the world, German Tier 1 manufacturers such as Bosch, Continental, and ZF are the spare parts supplier partners of global auto companies, providing auto parts such as transmission, steering, and chassis systems.

Denso in Japan, Mobis in South Korea, and Delphi in the United States all play a pivotal role in the global automotive Tier 1 suppliers.

Looking back at the star-studded era of fuel vehicles, leading car companies and high-quality upstream industry chain manufacturers are basically included in Europe, America, Japan and South Korea.In contrast, the power of suppliers in China's auto industry is relatively weak. Although they have been catching up with joint ventures for 20 years, they are frequently "stuck" by overseas manufacturers because of core components.

Starting late and having a weak foundation is an insurmountable obstacle for "underachievers".

However, when this pursuer, who is desperately imitating the scholar and has accumulated some experience in the manufacturing industry, encounters electrification transformation, everyone is leveled to a more similar starting line.

The biggest difference between electric vehiclesand fuel vehicles is the difference in the form of energy supply.Therefore, instead of the engine of a fuel vehicle, the three powers (battery, motor, and cell) of an electric vehicle have become the heart of driving the vehicle.

When the operating principle of automobiles undergoes a qualitative change, the products that auto parts suppliers need to provide will gradually shift from the past transmission, steering, and chassis systems to products with electric and intelligent features.

In other words, for traditional Tier 1 manufacturers, not changing means being revolutionized.

As early as 2018, the Tier1 international giant Bosch Group adjusted the business unit, integrated the gasoline system and the diesel system, and established the powertrain business unit.The starter and generator division was sold to a Chinese company in the same year.

Bosch's frequent involvement in emerging fields such as autonomous driving and silicon carbide (SiC) power semiconductors also shows that it is striving to seize market opportunities.At the beginning of 2022, Bosch and Volkswagen announced that they will cooperate in the development of autonomous driving software, striving to develop the latest technology that supports L3 autonomous driving technology and apply it to Volkswagen passenger car models.

As early as December 2021, Bosch Group announced that it will personally produce silicon carbide (SiC) power semiconductors, and set the targetproduction capacityat hundreds of millions. At the same time, it has also begun to develop second-generation SiC chips with higher power density.Currently, Bosch is the only auto parts supplier that produces SiC chips in-house.

The Bosch Group plans to expand production with the keen sense of its Tier 1 manufacturers. First, it is to catch up with the rapid growth of the electric vehicle market and the thriving SiC market. Second, the current SiC production capacity is seriously insufficient. Planning the production capacity in advance is conducive to seizing the market. commanding heights.

In fact, Bosch has become a loyal teammate of Tesla and other foreign car companies and many new car-making forces - Weilai, Ideal, and Xiaopeng have all adopted Bosch's electromechanical servo-assisting mechanism iBooster; Weilai even used the Weilai ES8 product Among them, Bosch's driving assistance systems, control units, sensors and iBooster components are used.

In terms of software such as autonomous driving, Bosch’s stepping is also quite accurate. On May 25, WeRide, which has just strategically funded China’s WeRide, is tantamount to seeing the development route for the gradual implementation of autonomous driving. aggressive signal.

It can be said that when the change has come, the top Tier 1 manufacturers represented by Bosch are not absent, but rely on the accumulation of global customers and a keen sense of smell to advance the layout.

Before the elephants turned around, some visionary leaders took the lead in adjusting flexibly.Such Tier 1 manufacturers have also brought assists in the electrification era to their OEM partners.

For more Tier 1 manufacturers who are still living on the fuel age, the electrification and intelligent transformation is imperative.

The warring states era of new Tier 1 players

Emerging giants who have been active in other segments in the past, but are expected to gain a share of the automotive industry by virtue of their own strength, have long been eager to try.

The advent of the era of electric vehicles has brought a bright future to Tier 2 manufacturers who have been deeply involved in the fields of chips and computing platforms in the past.

The fastest way to expand the track in the future is to enter Tier 1.

Today, a car-level AI chip technology manufacturer, Horizon, is becoming a dark horse to enter the emerging Tier 1.This intelligent computing platform with both software and hardware strength is increasingly favored by OEMs with higher pursuit of automotive intelligence.

Since 2021, Horizon has successively attracted investment from many car companies, and has almost become a hot star company in the field of automotive chips.Auto companies such as SAIC, Dongfeng, GAC, Chery Automobile, Great Wall Motor, and BYD have all participated in investing in Horizon, and have deep or shallow cooperation.

On the most recent June 27, Horizon announced that it has received a strategic investment from FAW Group and completed the delivery. This strategic investment will be used to strengthen the research and development of forward-looking technologyfor automotive-grade AI chips and the construction of engineering landing capabilities.

Horizon is so attractive, to a certain extent, thanks to its software and hardware product capabilities in the fields of AI chips, intelligent driving, and human-computer interaction. It has also reached strategic cooperation with autonomous driving companies such as Neolithic and MINIEYE.

In addition to the joining of the industry, the help of capital affirms its potential strength from the perspective of future development.

On June 15, 2021, Horizon completed a $1.5 billion C7 round of financing, with a post-investment valuation of up to $5 billion.In its big C round of financing, more than 35 investment institutions have been announced.It is reported that Horizon is considering going to the United States for an IPO, and the fundraising scale may reach 1 billion US dollars.

In the face of changes in the automotive industry, technology companies and software companies are also eager to try to promote changes in the supply chain ecosystem.

The reason why the automobile industry has attracted more top-notch cross-border players is that Yiou Automobile believes that there are three main factors:

1. The industrial chain has evolved from a linear relationship between OEMs, Tier 1, and Tier 2 to a more complex new mesh system;

2. The business model has changed from selling car hardware to Pro version of hardware plus follow-up services;

3. The automobile R&D process has changed from the integrated development of software and hardware to the separate development of decoupling of software and hardware.

Therefore, the independence of software as a component product brings opportunities for more software and technology companies.

New Tier 1 companies represented by Huawei and Baidu have strengthened cooperation with traditional car companies such as BAIC and Geely in terms of intelligent system platforms.

Huawei, which threatened not to build cars, chose to be the core components of the car with a Tier 1 attitude, and launched a "complete vehicle solution" around chips, modules, terminals, pipelines, and cloud platforms. It also developed with Audi, Toyota, and PSA. Connected cars are accelerating.

Baidu is obsessed with autonomous driving, and its L4-level Apollo is still undergoing road testing for autonomous driving.

The drone giant DJI also said that it hopes to provide "brains" and "eyes" for smart cars as Tier 1.Its wholly-owned subsidiary Livox provides lidar, while DJI is committed to helping vehicles realize L2+ and L3 "highway" and "urban expressway" intelligent driving and intelligent parking system solutions and components.

Neusoft Reach, Deutsch Microvision, Junlian Zhixing and other secondary subsidiaries hatched by listed companies such as Neusoft Group, Desay, Joyson Electronics, etc. are all working on extending from their areas of expertise to become ecosystems. It even actively seeks to go public, so as to satisfy the OEM's support for intelligent and technological business.

In this regard, Cao Bin, general manager of Neusoft Ruichi, once said in a dialogue with Zhao Fuquan: "The middleware will become more and more mature, and eventually a set of widely used standardized software will be formed, which will be integrated with corresponding management tools and adaptation services, etc. Combined together." He believes that the generalization of basic functions can help maintain the stability and reliability of automotive products for a long time.

Interestingly, in the horizon with the same Tier 1 "ambition" as Neusoft Reach, its founders and CEOs Yu Kai and Cao Bin have highly similar views.

He believes that there is no need for OEMs to do Tier 1 by themselves, and there is no need to aspire to obtain long-term barriers to the future through some current new technology.Because valuable technologies will eventually be industrialized and popularized, the best solution is to use external ecological acquisition to achieve the effect of "four or two".

However, in order to take over the work of Tier 1 manufacturers, manufacturers with hardware capabilities may be better at building ecological chains than pure software manufacturers.However, software manufacturers can also use software integration as a breakthrough to form their own software ecosystem and create a computing platform exclusive to car companies.

In Yiou Auto's view, the first players who may have an impact on traditional Tier 1 manufacturers are Huawei, Baidu, DJI, Horizon, and Neusoft Reach, who have the advantage of being a scarce head, and at the same time have the strength of software and hardware integration. Motivated players with mature industry chain ecology.

The upstream layout of the main engine factory gives you a little more sense of security

The advent of the electrification era has brought a series of opportunities for Tier 1 and quasi-Tier 1 manufacturers in the field of automobile manufacturing.But putting the chokepoint in the hands of opponents/teammates is not what OEMs want.

Smart car brands like "Weixiaoli" have had strong vertical integration expectations for autonomous driving-related hardware and software technologies since their birth.If the strength allows, it is still a very reliable choice for the OEM to take over Tier 1 although the cost is high.

In fact, the self-research of software and hardware technologies related to autonomous driving has almost become the traditional car-making giants such as Mercedes-Benz, Audi, BMW, GM, and Honda, as well as Tesla and NIO, Xiaopeng Motors, Ideal Automobile and other manufacturers. A must for new car forces.

In this regard, there is a more vivid statement in the industry - the "supply chain" of global OEMs.

In the past, OEMs only needed to clearly define the function to the supplier and wait for the supplier to find a product that meets their needs.

Now, OEMs may be more picky about the strength of suppliers and their products, and even in some areas, by controlling supply chains and core technologies, they have established stronger industry barriers.

This transformation is influenced to a certain extent by the Tesla model - skipping Tier 1 and facing Tier 2, directly and deeply involved in the development and manufacturing process of automotive software and hardware, and becoming an Apple-style technology travel company.In recent years, various factors have led to a substantial increase in the cost of chips and power batteries, which has also given a boost to OEMs with this trend.

Although NIO Pilot of NIO, Xpilot of Xiaopeng Motors, and FSD of Tesla are all on the road of layer-by-layer evolution from assisted driving, the specific technical paths show their very different development considerations.

For Tesla, in order to avoid being overly dependent on external sensor suppliers and being controlled by others, Tesla has focused its strategy on data and algorithms, hoping to rely only on cameras (visual sensors) to build a reliable autopilot system.

Although this sounds competitive and can cover a nearly 360-degree field of view, it still only stays at the L2 level, requiring direct driver intervention at critical moments.

Weilai's NIO Pilot is more similar to the conventional Tier1 in terms of integration, and belongs to the L2-level automatic assisted driving system.It integrates 22 sensors.

The ET7 model released in January 2022 upgrades Pilot to NAD (NIO Autonomous Driving) system, adds 1 lidar and more cameras, and is also equipped with a high-precision map positioning unit, V2X vehicle-road coordination unit, and driving staff monitoring system.

The autonomous driving system Xpilot of Xiaopeng Motors is also in the process of continuous evolution, and has now developed to version 3.5.

Among them, the automatic navigation assisted driving NGP (Navigation Guided Pilot) function is an assisted driving function realized by the Xpilot system combined with the navigation path. After this function is turned on, the vehicle can basically realize point-to-point automatic navigation assisted driving.

We don't know whether the OEMs that continue to extend further upstream in the industry chain can consolidate barriers in this way by in-depth layout of Tier 1 system integration for a sense of security.

However, the visible research and development costs and the multiplied workload in the manufacturing process have all lit up warning lights for these "rolling too hard" OEMs.

Epilogue

A certain window of time and a special successful case have aroused thousands of waves. Whether to do Tier 1 or not often refers to whether you can master the core technology and whether you can have sufficient control over the upstream and downstream industries.

In short, if there is a longer-term pursuit in the field of smart travel, other people's children are spending more time and money on "tutorial classes", or they spend extra time in private schools, who has the determination to let themselves go and lie ahead. flat.

For entrants, the only criterion for testing their own business logic is the long-term market performance in the future.Different from a specific technical competition, system integration is a more comprehensive challenge that tests the subject's ability to control and mobilize resources from all parties, as well as the degree of monopoly on core technologies.

It is foreseeable that the future competition in the Tier 1 field will be an open and secret battle between giants.After the reshuffle of the industry, what will be precipitated will be the true rules of the game in the field of electric vehicles in the future.

Statement: the article only represents the views of the original author and does not represent the position of this website; If there is infringement or violation, you can directly feed back to this website, and we will modify or delete it.

Preferredproduct

Picture and textrecommendation

2022-08-04 12:57:12

2022-08-04 12:56:48

2022-08-04 12:56:28

2022-08-04 12:56:04

2022-08-04 12:55:36

2022-08-04 12:55:11

Hot spotsranking

Wonderfularticles

2022-08-04 12:54:48

2022-08-04 12:54:20

2022-08-04 12:53:54

2022-08-04 12:53:32

2022-08-04 12:53:03

2022-08-04 12:52:26

Popularrecommendations