Your location:Home >Automotive News >

Time:2022-07-13 14:47:02Source:

In June, the domesticnew energy vehiclemarket officially turned for the better, and the loading volume of major battery manufacturers also hit a record high.According to data from the China Automotive Power Battery Alliance, the total installed capacity of domestic power batteries in June was 27.0GWh, a year-on-year increase of 143.3% and a month-on-month increase of 45.5%.

Among them, CATL still occupies the first position with a loading volume of 13.4GWh; BYD is second, with a loading volume of 5.01GWh, occupying 18.53% of the market share; LGNew Energy, which ranks third , although somewhat unexpected In addition, it is reasonable to see Tesla's sales in June.

China Innovation Airlines and Guoxuan Hi-Tech, ranked fourth and fifth respectively, belong to the same level as LG New Energy in the domestic market. After all, in terms of vehicle loading, there is not much difference between the three.The 6th, 7th, 8th, 9th, and 10th place belong to another level. Here are Xinwangda jointly invested by Wei Xiaoli, Honeycomb Energy supported by Great Wall, and Ruipu Energy supported by "nickel king" Qingshan...

Coupled with the power battery companies ranked 11-15, four battery manufacturers can be simply divided into "head-shoulder-waist-foot" forces.They have completely divided up the domestic power battery market share, some people eat meat, some people drink soup, and finally form such an "inverted triangle" market structure.

Unfortunately, this pattern is unlikely to change in a short period of time.There are three reasons: First, the advantages of scale accumulated by battery manufacturers in the early days are snowballing; second, the power battery is compatible with the design structure of the whole vehicle, and the replacement of car companies requires time and cost reassessment; third, the development of battery technology The bottleneck period has come.

However, it is worth mentioning that the current market trend has changed.

In the first half of 2022, car companies continue to look for the second and third supply of power batteries, which has become a "secret" on the surface; the price of upstream raw materials has skyrocketed, and the reconstruction of the supply chain system is imminent; after the Ningde era fell to the "trillion" altar, Efforts to find the peak of the past; BYD's market value exceeded the "trillion" market value, officially turning "one super" into "two strong"...

In fact, the hurricane that swept the entire power battery market has just taken shape.

In the first half of the year, the storm is coming

The price increase of new energy vehicles is one of the key words in the first half of this year.

It is understood that whether it is lithium carbonate, the basic material necessary for lithium batteries, or other precious metal materials such as nickel, cobalt, and manganese, it has risen to a daunting level.Li Xiang, the founder of Ideal Motors, even publicly stated: "The increase in battery costs in the second quarter is very outrageous."

Due to the transmission effect of the power battery industry chain, the cost is transmitted from the upstream raw material supplier to the power battery companies in the midstream, and then to the car companies, and finally increases the price on consumers.

From the point of view of market regulation, the occurrence of this phenomenon does not violate the rules, and consumers seem to accept it widely.But on the other hand, it is not good news for the power battery industry to be clamped by upstream raw material suppliers for a long time.

From January to June, the domestic power batteryoutputaccumulated to 206.4GWh, a year-on-year increase of 176.4%.Among them, the cumulative output of ternary batteries was 82.9GWh, accounting for 40.2% of the total output, a cumulative increase of 125.0% year-on-year; the cumulative output of lithium iron phosphate batteries was 123.2GWh, accounting for 59.7% of the total output, a cumulative increase of 226.8% year-on-year.

It is not difficult to see that theproduction capacityhas not been weakened by the rise in raw material prices, and even in the past June, it has reached a new high in production.However, the problem of overcapacity behind this is also on the rise.

Expanding production capacity and investing in factories must be the first thing all power battery companies want to do after they get the money.

According to incomplete statistics, in the first quarter of this year alone, there were a total of 29 new power battery projects in China, with a total investment of 339.11 billion yuan and a planned power battery production capacity of nearly 877GWh.

In the second quarter, the "nickel madness" incident had just subsided, and CATL also dropped its market value by trillions due to the "increase in revenue but not profit" in the first quarter financial report.However, the expected situation of "one whale falling for all things" did not appear, and the Ningde era stabilized the stock price at 500 yuan with the release of the Kirin battery.

In fact, it is not difficult to understand that the foundation of the Ningde era in the market is really too thick.Not only does it have a stable domestic market share of about 50%, but also stabilizes at more than 30% in the global market.

If someone says that BYD is a great threat to the Ningde era, I am afraid that they only see the strong side of BYD in the lithium iron phosphate battery in the power battery market, while ignoring the strong performance of the Ningde era in the field of ternary lithium batteries.

In all fairness, if you only look at the loading volume, it is an indisputable fact that the Ningde era "one dozen ten".But for the balance of the entire power battery industry, the market will not transfer most of the benefits to a company or a certain link in the industry chain for a long time, and everything is being adjusted slowly.

As mentioned earlier, the surge in raw materials upstream of batteries has made raw material suppliers a lot of money, and it has also caused power battery companies and car companies to suffer a lot.Such uneven distribution of benefits will inevitably cause "unpleasantness" to many people, and this means that the opportunity for the restructuring of the power battery industry chain has come.

In the second half of the year, do not break

Undoubtedly, China is not only one of the largest markets for new energy vehicles, but also a power battery powerhouse.

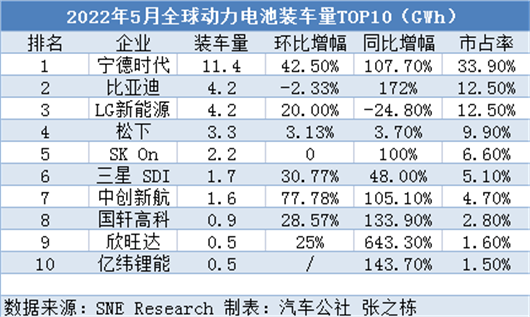

According to data from South Korea's SNE Research, 6 of the top 10 companies in the world in terms of vehicle loading are Chinese companies.And it is worth mentioning that BYD has ranked second for two consecutive times, not much inferior to LG New Energy.

In terms of scale, production capacity, and completeness of the supply chain, the continuous expansion of the domestic power battery market is indeed something to be proud of.But on the other hand, while being "confident", we must beware of "conceit."

Regarding the development direction of power batteries, there are no more than three points: improving energy density, ensuring safety and life, and reducing costs.

Judging from the current situation, the main body of power battery research and development is still battery manufacturers and car companies, and they will make efforts in many aspects such as materials, processes, and battery systems.

However, it is a pity that whether it is the Kirin battery of the CATL era, or the blade battery of BYD, the short knife of Honeycomb Energy, and the One-stop of China Innovation Airlines, they are all innovations in the structure of the battery system.

There does not seem to be much progress in research on battery materials.The main development trends are mostly manifested in the reduction of cobalt in the positive electrode to the absence of cobalt, the addition of silicon in the negative electrode, and the conversion of electrolyte to solid electrolyte...

Taking the hot solid-state battery as an example, according to the data of the investigation agency Patent Result, Japanese companies are in a leading position in the number of patents for all-solid-state batteries.

It is understood that the top five companies in the number of patents are Toyota, Panasonic Holdings (HD), Idemitsu, Samsung Electronics, and Murata Manufacturing.Among them, Toyota ranked first in the number of patents, with 1,331 patents, more than three times that of Panasonic.

And it is worth noting that in the top ten, there is not a single company from China.Even the "world's first" Ningde era failed to make it into the list.

Seeing the small and knowing works, one day in the future, will Japanese and Korean companies re-wield the "patent stick" and "kill" the Chinese market.Does the so-called "white list" still have to be picked up again and given policy support again?

Perhaps in the eyes of many companies, solid-state batteries are not that important, and scientific research innovation is not a high priority.But for power battery companies, how to achieve a balance between long-termism and short-term benefits has become an urgent issue.

In fact, it is precisely because of years of hard work that the current power battery market is in a good situation.But it has to be admitted that the "savage growth" of the industrial chain for a long time has produced many loopholes and deficiencies in the industry.

The market does not need a dominant company, nor does it need a certain supply chain link to have the exclusive right to speak.The good news is that car companies have already taken the lead in making changes for their own interests, or looking for secondary or tertiary supply, or even simply end up building batteries themselves.

Therefore, for power battery companies, is it more important to continue to "be the king" in the second half of the year, or is it more important to change the concept after breaking through?

Statement: the article only represents the views of the original author and does not represent the position of this website; If there is infringement or violation, you can directly feed back to this website, and we will modify or delete it.

Preferredproduct

Picture and textrecommendation

2022-08-04 12:57:12

2022-08-04 12:56:48

2022-08-04 12:56:28

2022-08-04 12:56:04

2022-08-04 12:55:36

2022-08-04 12:55:11

Hot spotsranking

Wonderfularticles

2022-08-04 12:54:48

2022-08-04 12:54:20

2022-08-04 12:53:54

2022-08-04 12:53:32

2022-08-04 12:53:03

2022-08-04 12:52:26

Popularrecommendations